Costing methods that only consider direct or indirect costs, but not both, will not be appropriate for reporting inventory costs as part of your tax obligations. However, they can be very useful for identifying which systems, materials, processes, and overheads impact profitability – and how. In addition, the use of absorption costing generates a situation in which simply manufacturing more items that go unsold by the end of the period will increase net income. Because fixed costs are spread across all units manufactured, the unit fixed cost will decrease as more items are produced. Therefore, as production increases, net income naturally rises, because the fixed-cost portion of the cost of goods sold will decrease.

Activity-Based Costing (ABC) Principles, History & Steps

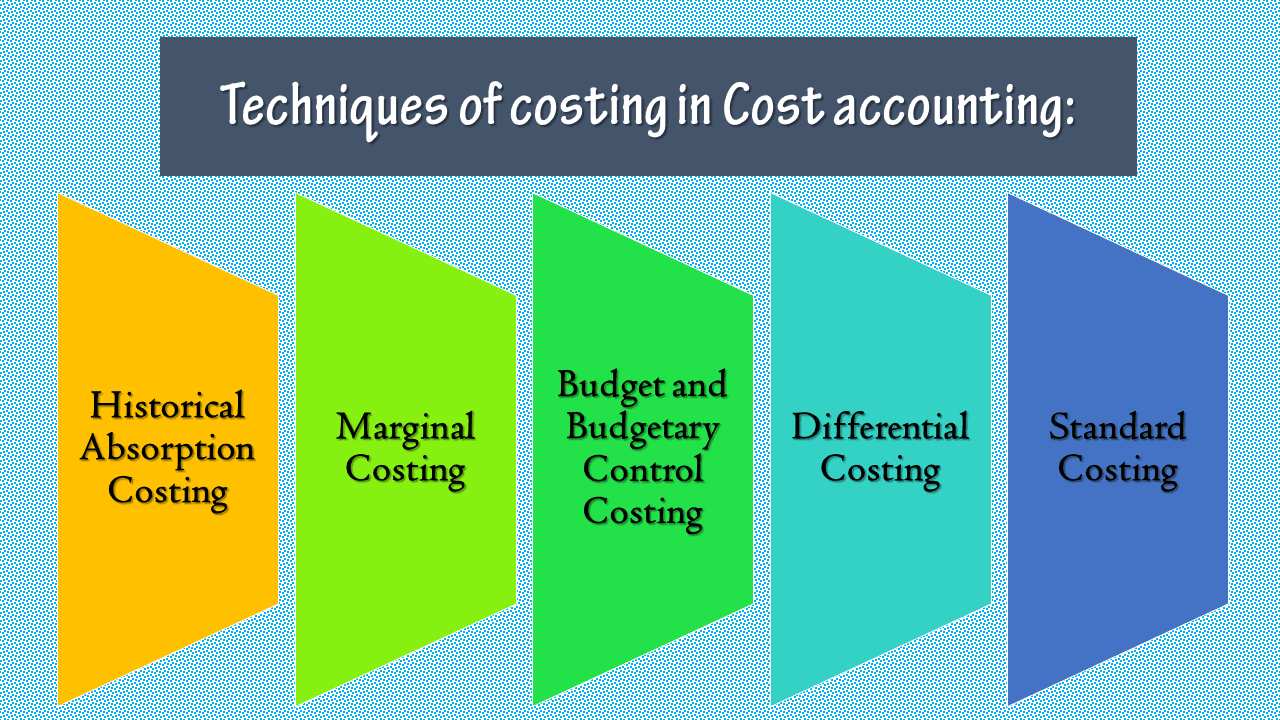

By investing in robust product costing practices, businesses position themselves for success and create a strong foundation for long-term prosperity. Activity-based costing is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Activity-Based Costing (ABC) is an accounting method that assigns costs to specific activities within a business, and then allocates those costs to products based on the resources used for each activity. Marginal costing can tell you whether it’s possible to produce more items, all sold at the same price point, without a significantly higher production cost. This process allows you to maximise profit by determining exactly how increased production impacts margins. This example demonstrates how the FIFO costing method takes into account inflation.

- It’s important to note that the accuracy of the materials cost calculation depends on obtaining reliable sourcing information for ingredient prices.

- In job costing, the costing of each job undertaken and executed is calculated.

- A more intricate way of calculating your costs is known as activity-based costing.

- However, fixed costs are limited to a set time period because they can fluctuate over the long term.

- These costs are directly traceable to a specific product and include direct materials, direct labor, and variable overhead.

Using software to calculate the costs

It also helps you make informed decisions when it comes to adjusting your selling prices, switching suppliers, and tweaking your bills of materials or recipes. Under absorption costing, all manufacturing costs, both direct and indirect, are included in the cost of a product. Absorption costing is typically used for external reporting purposes, such as calculating the cost of goods sold for financial statements. A costing methodology known as “activity-based costing” is a method of comparing costs based on the cost of goods and services.

Traditional Absorption Costing

As manufacturing progresses, direct materials, direct labor, and manufacturing overhead are calculated in real-time by the software system itself according to the reporting inputs from workers. As you have arrived at the cost per unit of your products, you can use these numbers as a jumping-off point for determining their optimal selling prices. Activity-based costing looks into the cost of each unit from mass production runs depending on the activities involved in making it — ABC is a more sophisticated version of job costing.

These changes have resulted in increased complexity and bifurcation (separation into two parts) of production processes, which is reflected in the cost structure. Last-in, First-out (LIFO) is an inventory costing method that assumes the goods purchased most recently will also be sold first. This method is widely regarded as a poorer indicator of 1 5 exercises intermediate financial accounting 1 ending inventory value compared with FIFO because it can understate the true value. Product costing provides a basis for evaluating the performance of products and identifying areas for improvement. By comparing actual costs with expected costs, businesses can pinpoint inefficiencies, streamline operations, and enhance overall productivity.

In manufacturing, a marginal cost is the change in total production cost that occurs when one additional unit is manufactured. Marginal costs are calculated to optimise production and determine the point at which your business is likely to achieve economies of scale. In traditional cost accounting, you usually tally up your overheads and split them evenly across your activities. This can help to understand costs at a glance, but it doesn’t take into account significant variations between activities.

Incorrect overhead allocation can result in products being overpriced or underpriced. Manufacturing overheads can be the trickiest to estimate of all the costs mentioned. All indirect expenses incurred in operating a firm, such as rent, utilities, and insurance, are referred to as overheads.

The best way to simplify the manufacturing costing process is through software. An ideal solution for this is MRP (Manufacturing Resource Planning) software. MRP software is a production management tool that supports various costing methods like job costing, product costing, cost estimating, and actual costing. Actual costing, in particular, is an important feature to look for in MRP software, allowing you to accurately track ingredient and labor costs in near real-time.